APPLY NOW

Feel free to download and complete the pertinent application below regarding License or Ordination with the World Bible Way Fellowship (WBWF). There is also an option to apply as a Christian Worker. NOTE: The application fee may be paid by using the ‘GIVE’ tab above (top right) or by mailing a check/money order to World Bible Way Fellowship, Inc., P O Box 506, Ben Franklin, Texas 75415.

CHRISTIAN WORKER APPLICATION

NEW MINISTER APPLICATION

ANNUAL RENEWAL

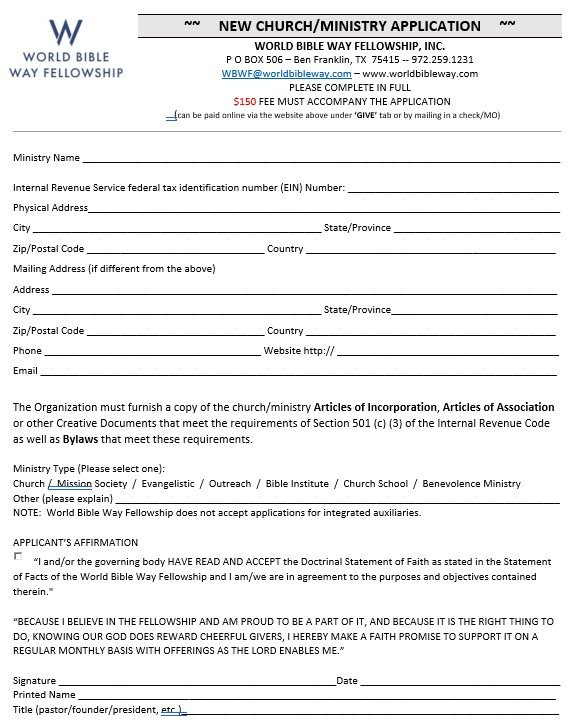

NEW CHURCH/MINISTRY APPLICATION

NEW APPLICANT PROCESS INFORMATION

The process for a new applicant desiring to affiliate with the World Bible Way Fellowship (WBWF) is as follows:

• download a new minister application from the link above

• complete the minister application in full

• be sure to include a photo, indicate what type of credential is being applied for, provide at least 2 letters of recommendation from ordained ministers (preferably WBWF ministers) or the board of an affiliated Fellowship church • must affirm that the Statement of Faith has been read and that you subscribe to it by signing and dating the application

• include a narrative letter of introduction providing us with information about you, your ministry, and your reason for seeking credentials with WBWF

• submit the application fee (noted on the application) via check or money order or by utilizing the “GIVE” tab (top right) from this page

• return all required documents & the fee to the fellowship's home office at P O Box 506, Ben Franklin, Texas 75415. We will issue a License to Preach for those who have established a proven ministry. After a licensed minister has actively been a member of WBWF for at least 2 years he/she may then apply for Ordination with their pastor’s recommendation. All new members must apply for a licensed minister first unless they meet one of the exceptions listed below. There are 2 exceptions to having to apply for license first:

• If a minister is currently ordained with a ‘like’ organization, WBWF will honor that and allow transfer of ordination rather than application for license if approved by the President of the WBWF.

• If a minister is the Senior Pastor of a church, WBWF will waive the license requirement and allow ordination at the request of the church board if church bylaws make it a requirement. Documentation must be provided to support the applicable exception. Once credentialed, to be eligible for continued membership, all applicants must annually renew their credentials and affirm that they subscribe to the Statement of Faith. This requires a renewal application (found above) sent to the WORLD BIBLE WAY FELLOWSHIP, INC. New Applicant Process Info to be completed in full which includes an update of the member's current ministry, submission of the renewal fee, and signing and dating the Applicant's Affirmation statement. All credentials expire one year to the date of issue and noted on the individuals credential wallet card.

501 (c) (3) GROUP COVERAGE INFORMATION

for Current and Prospective Church /Ministry Subordinates

Be it known that World Bible Way Fellowship, Inc. (WBWF) is not qualified to provide tax advise. The following is our understanding of how the IRS currently views the 501c3 coverage. Note that all IRS regulations are subject to change without notice. Please do your own due diligence to be sure.

World Bible Way Fellowship, Inc. headquartered at 4900 FM 128, Ben Franklin, Texas 75415 (P O Box 506) is recognized as exempt from federal income tax. This organization is currently exempt under section 501c3 of the IRS code under its Employee Identification Number (EIN).

The IRs recognizes the subordinates of the WBWF as exempt from federal income tax under section 501c3 of the code, even though they are not listed separately.

IRS records indicate that contributions to the WBWF organization and its subordinates are deductible under section 170 of the code, and are qualified to receive tax deductible bequests, devises, transfers or gifts under section 2055, 2106 or 2522 of the IRS code. The covering is provided by the IRS Group Exemption Number.

This covering, or umbrella, keeps other non-profits (entities, not individuals) from having to file federal income taxes. The umbrella provides exemption without the ministry having to obtain its own 501c3 which can be costly. With regards to the IRS, it is better for a small ministry to be part of an organization recognized by the IRS.

State sales tax exemption is different for each state. Generally, each church or ministry has to file for exemption themselves if they want to be exempt from sales tax. Churches don’t generally need sales tax exemption. A church’s coverage under the umbrella makes them qualified to receive donations/contributions and issue receipts for a tax deduction. Non church ministries usually need legal work to qualify for state tax emptions and/or federal exemption.

In order for a church or ministry to obtain coverage under the WBWF umbrella, the president/founder/pastor must be an active member in good standing with the fellowship. The church/ministry can only be affiliated with this fellowship if the minister meets the above requirements. This means that if the minister fails to renew each year and therefore becomes inactive, the church/ministry is not renewed and therefore is no longer covered by the WBWF umbrella.

The application process for a church/ministry to become affiliated with WBWF is separate from the minister application. There is a one-time fee of $150 involved with the initial application. However, each subsequent year the church/ministry will renew automatically when the minister renews.

Please note that no member or subordinate organization may use the WBWF EIN# or any purpose including, but not limited to, banking. Each member church/ministry must supply their individual EIN# from the IRS by filing form SS-4 at IRS.GOV.